Knowing how to check the UIF payout schedule is essential for everyone registered for this fund. The South African government initiated the Unemployment Insurance Fund to provide short-term financial relief to the unemployed, including those who cannot work. After registration, you must follow up on when you will receive the funds.

Since South Africa's unemployment rate continues to rise, the government has to implement the Unemployment Insurance Fund to cushion its socioeconomic effects. Hence, the agency's primary role is to give unemployed people something to fall back on.

How to check UIF payout in 2023 (how to check UIF status via phone)

The UIF benefits are only extended to individuals who retire from formal employment and those employed in the formal sector but have been laid off or cannot work.

UIF now has mobile phone services. Call 012 337 1680 to check your status progress or dial the UIF status USSD code, *134*843#, and follow the prompts.

Like most insurance schemes, you must pay a specified percentage of their salary to the UIF treasure trove. Otherwise, you will not benefit from this policy.

Most employers make Unemployment Insurance Fund payments on behalf of their staff. You can apply for UIF benefits when your employer lays you off.

To qualify for benefits, register with the Unemployment Insurance Fund, pay your contributions promptly, and apply for the UIF benefits within six months of being fired or as soon as you become unemployed.

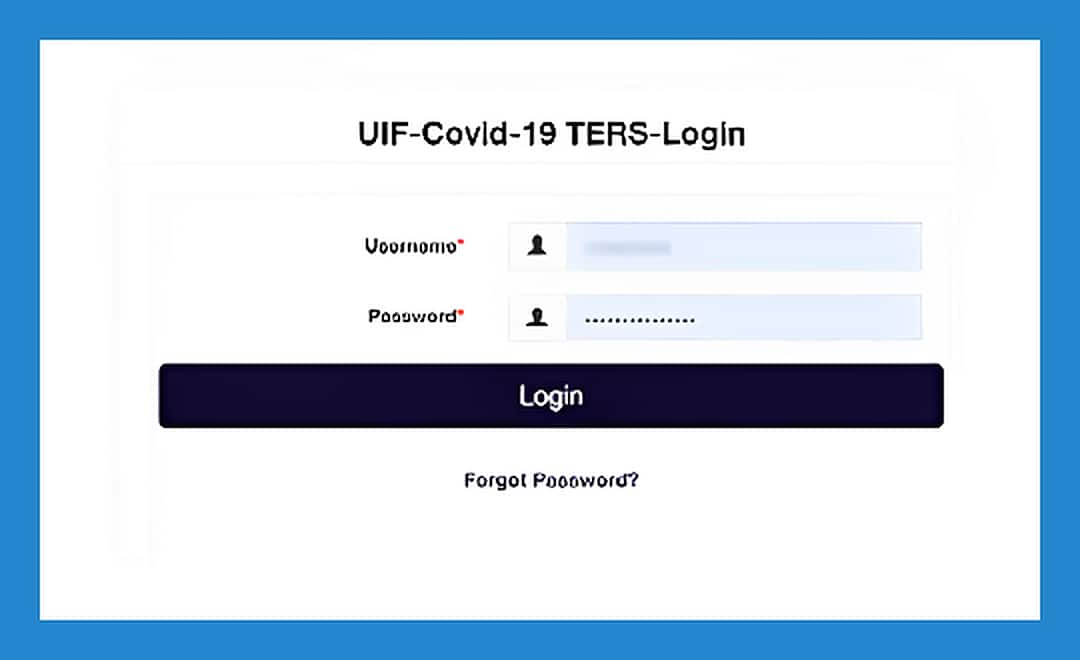

UIF status check online

Learn how to check UIF payout online today. The different methods of confirming the progress of your payment are easy if you have detailed instructional material, and the online UIF payment status-checkingprocess is straightforward. Here is how you do it:

- Click STATUS in the menu bar to see your payment status, processed date, and amount paid. Processed means that the system has picked up the application, and if the Rand Value is zero, your payment has been rejected.

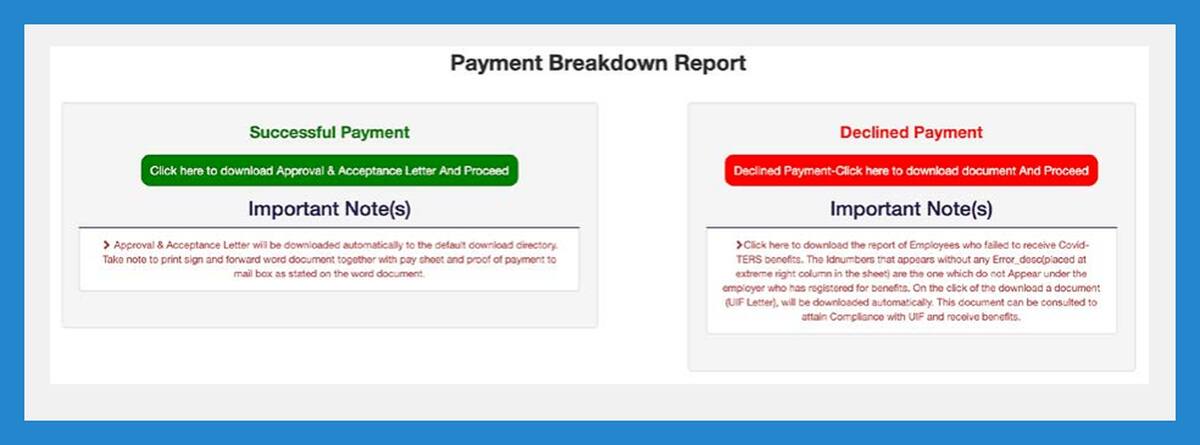

- Click PAYMENT BREAKDOWN REPORT in the menu bar and choose Successful Payment (green) or Declined Payment (red), depending on your status.

- Click EXCEL to download a list of paid employees and how much each received (if you clicked Successful Payment).

Meanwhile, those who clicked Declined Payment will download a list of employees who have been declined payment.

Clicking Successful Payment will automatically download a letter. Sign and send the document to covid19UIFemployerpaymentreturns@labour.gov.za. Attach proof that you have distributed the funds to your employees in the email.

If you selected Declined Payment, please analyze the Payment Reports to determine why the system notifies you about a rejected payment. The system declines payments due to the following reasons.

- The employer has not declared the employee. You should declare the employees you have paid their Unemployment Insurance Fund contributions on the uFiling website.

- The application has not been processed. Therefore, make the payment in a few days or wait for your employer to do so.

- You used the wrong Branch Code Validation. Hence, check and update your profile or request your employer to do so. You should use the Universal Branch code.

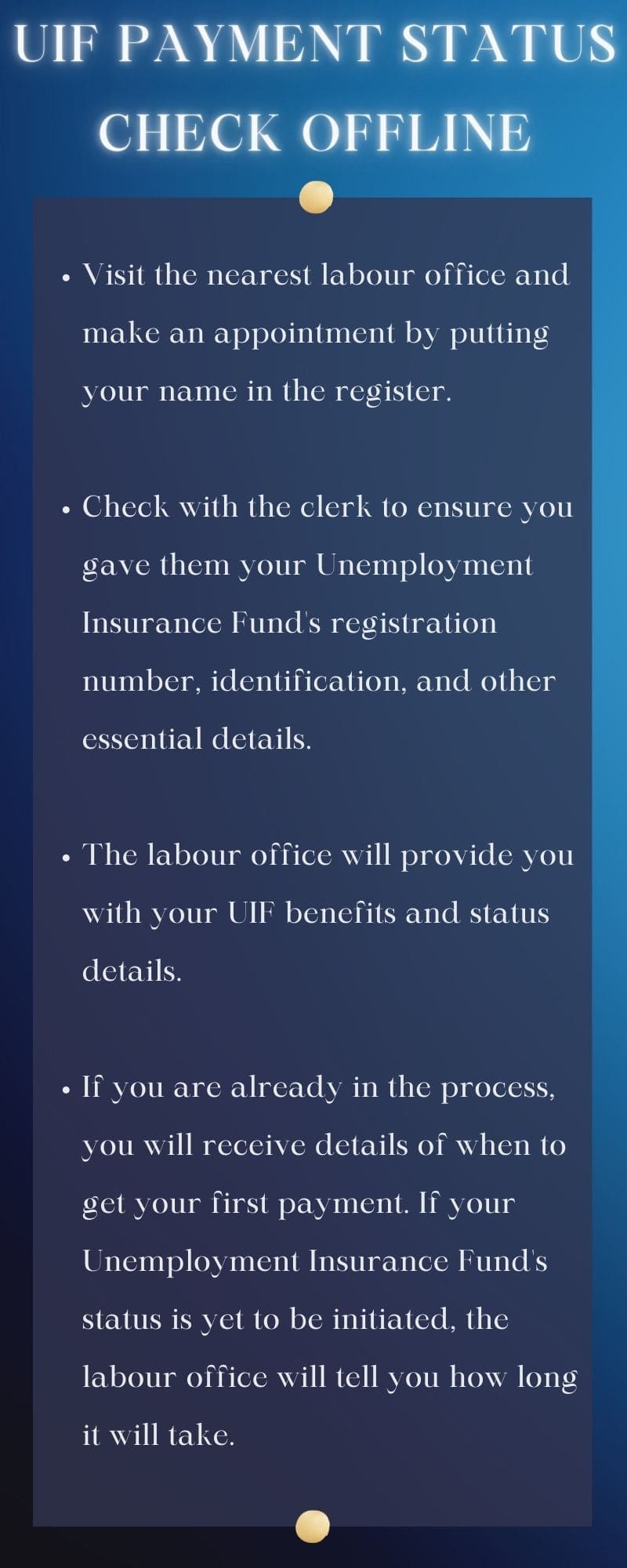

UIF payment status check offline

UIF TERS means Temporary Employer / Employee Relief Scheme. Anyone who cannot use the online or phone method can also check their UIF TERS payment status at the labour office.

- Visit the nearest labour office and make an appointment by putting your name in the register.

- Check with the clerk to ensure you gave them your Unemployment Insurance Fund's registration number, identification, and other essential details.

- The labour office will provide you with your UIF benefits and status details.

- If you are already in the process, you will receive details of when to get your first payment. If your Unemployment Insurance Fund's status is yet to be initiated, the labour office will tell you how long it will take.

What forms are needed to claim UIF in South Africa?

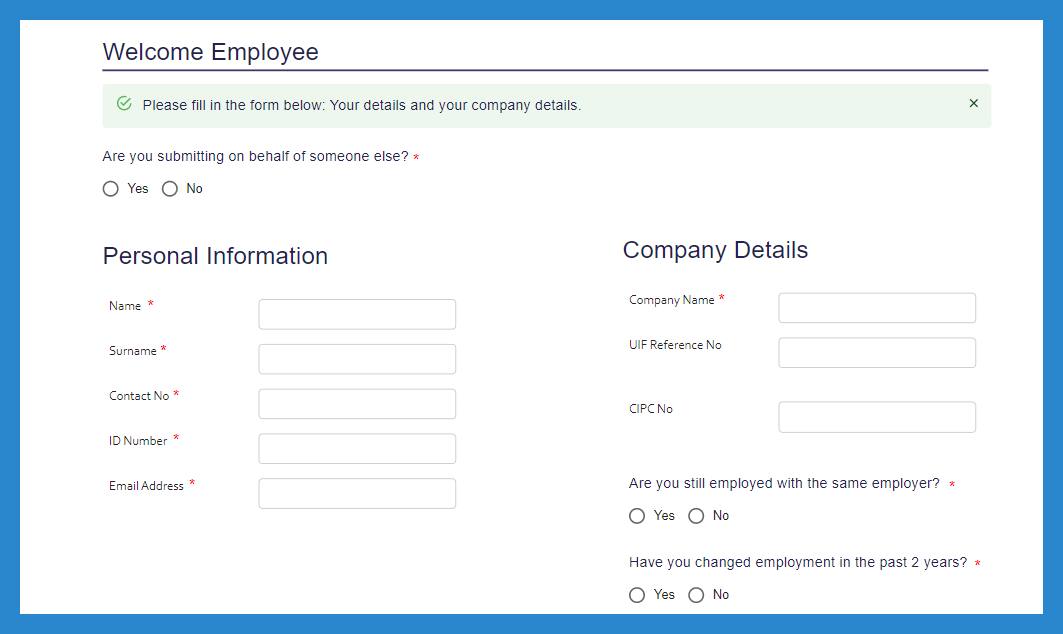

After understanding how to check the Unemployment Insurance Fund payout, you must know the documents needed to make a UIF claim. You must have:

- UI-2.1 (application form)

- Copy of your ID document

- UI-19 and UI-2.7 (completed by employer)

- UI-2.8 (bank form completed by the bank)

- A letter from your employer confirming Reduced Work Time or Temporary Lay-off due to the Coronavirus.

What is the UIF payout process?

You should start receiving the UIF benefit money within eight weeks of filing a claim. The government agency will send the money to the bank account you registered with.

The Unemployment Insurance Fund will make payments every four weeks until the funds are depleted. You will also get a slip that tracks the payments. Use a UIF calculator to know how much money you should expect.

What types of benefits can be claimed from the UIF?

There are several UIF benefits for requested and qualified members. The Minister of Labour determines a benefit scale for paying out benefits. The scale considers the individual's monthly income. These benefits include:

- Illness benefits

- Unemployment benefits

- Maternity benefits

- Dependent benefits

- Adoption benefits

- If an employee loses part of their income due to reduced working hours.

How to check UIF payout balance?

UIF does not provide an option for checking your balance. Nevertheless, you can learn how to calculate your daily and annual payout/benefits.

How to calculate UIF benefits?

Here is how UIF calculates your payout:

- UIF calculates your average monthly salary for the last 6 months before your claim your benefits. UIF also caps salary at R17 712.

- UIF determines your daily income (Y1) using this formula: (The average of your salary x 12 months) / 356 days

- UIF then calculates your income replacement rate (IRR). The IRR formula is 29.2 + (7173.92/ (232.92 +Y1)

- IRR is the percentage of your daily income you are entitled to as UIF benefits. Please note that IRR is 38 % minimum and 60% maximum of your daily income.

- Calculate your daily UIF benefits using this formula: IRR x your daily income

- Your total UIF benefit amount is your daily benefit amount multiplied by your available credit days.

- Credit days are accumulated as follows: for every four days you work as a contributor, you receive one day’s credits subject to a maximum of 365 credit days.

- If you work for all 260 weekdays of the year, you have 52 credit days.

Example

If you earn R17 712 monthly and worked for all 260 weekdays of the year. Here is how you calculate UIF payout:

| Steps | Formula | Calculations | Results |

| Average salary for 6 months | (Monthly salary x 6 months)/ 6 months | (R17 712 x 6 ) / 6 | R17 712 |

| Daily income (Y1) | (Average monthly salary x 12 months) / 356 days | (R17 712 x 12 ) / 356 | R597.034 |

| IRR (%) | 29.2 + (7173.92/ (232.92 + Y1) | 29.2 + (7173.92/ (232.92+ 597.034) | R37.35 |

| Your daily UIF benefits | IRR x your daily income(In this case, you will use 38%. It is the minimum IRR allowed) | 38% x 597.034 | R226.87 |

| Total Annual Benefit Amount | DBA × available credit days | 52 x 226.87 | R11,797.24 |

How to check maternity UIF payout

For example, if your salary is R15,000 and you get R20,000 wage on leave, here is how the calculate your UIF maternity payout benefits:

| Steps | Formula/calculations | Amount |

| Daily income (YI) | (monthly salary × 12 months) ÷ 365 days(R15000 x 12) ÷ 365 = R493.15 | R493.15 |

| Daily benefit amount (DBA) | 66% of daily incomeR15,000 x 66% = R9,900 | R9,900 |

| Daily income while on leave (leave income) | (Leave income × 12 months) ÷ 365 days(R20,000 x 12) ÷ 365 = R657.53 | R657.53 |

| Top-up | (Daily income (Y1) – leave income)R493.15 – R657.53= – R164.33 (difference) | – R164.33 |

| Daily UIF maternity benefits | – R164.33 |

N/B

Where the difference is less than the Daily Benefit Amount, the difference is paid. Where the difference is more than the Daily Benefit Amount, the daily maternity benefits amount is paid.

- Your UIF maternity benefits will be R226.87 (Daily UIF Benefit Amount) instead of – R164.33.

Can I pay UIF from multiple bank accounts?

You can provide several bank accounts while registering on the uFiling website but select the account you will use to send your Unemployment Insurance Fund contributions because you cannot make payments for one person using different accounts.

Can I claim UIF online in South Africa?

The Unemployment Insurance Fund will soon launch a Virtual Office for its staff to serve people online in real-time. Therefore, the public will be able to access all UIF services online.

What happens to my UIF contributions if I resign?

The Unemployment Insurance Fund's policies state that you cannot claim your benefits if you resign, get suspended, or are absconded from work.

However, the Commission for Conciliation, Mediation, and Arbitration (CCMA) might consider your reason for resignation as a constructive dismissal and allow you to make a claim.

How do I repay the UIF?

You are expected to refund UIF money if these situations happen:

- If you received the wrong amount.

- You applied for the wrong people.

- Some of your employees have returned to work, and you have paid all or a portion of their salary.

Send your refund to:

- UIF's FNB current account number: 51420056925

- Branch code: 23-31-45

- Reference: C+UIF reference number (e.g. C7654321/7)

Can foreigners apply for UIF in South Africa?

The Unemployment Insurance Fund pays all registered and qualified workers, including properly documented foreign nationals. Therefore, foreigners permanently employed in SA also qualify for Unemployment Insurance Fund benefits.

Essential points to note about UIF benefits

- You should register a domestic worker with over 24 working hours per month with the UIF.

- The employer and employee (each) contribute 1% of the employee’s salary to the Unemployment Insurance Fund per month.

- Benefits may not be attached by a court order to pay your employee or third-party debt but can be done to pay a dependent child or spousal maintenance.

- You will be disqualified from Unemployment Insurance Fund's benefits if you do not comply with the unemployment laws.

- Apply for an Unemployment Insurance Fund claim within the prescribed period to qualify for benefits.

- An employee should register a domestic worker with over 24 working hours monthly with the UIF.

- You will be suspended from receiving a UIF benefit if you make a dishonest claim.

- Dependents of a deceased employee can claim benefits from the UIF.

Now that you know how to check the UIF payout, prepare your application documents. The personal details you use on the registration form must be correct because that will determine if your payment process will be activated or declined.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: UIF contact details: who to contact for assistance on UIF and TERS and how to

We shared UIF contact details. You can reach out to them for more inquiries about their insurance services. The Unemployment Insurance Fund (UIF) is open for private and civil sector employees.

UIF can give you short-term financial relief when you lose your job or cannot work because of maternity, adoption, parental leave, or illness. You can also benefit if you depend on a deceased UIF contributor.

ncG1vNJzZmiaop6yp7jYZ5qoZqqWfKetwq2qZqSZm7KprcKkqmirlafDqq%2FErGZqaWhsgHh5x6iuZpuYmrCsedSinWaoka68tsCMrKCmqJyaerTAxKmqZpuYmrCsedSinWaslafAbrzAsqSepqRiwLWt066qaA%3D%3D